Welcome to the thrilling world of self-employment! You get to be your own boss, set your own hours, and... navigate the complex labyrinth of tax laws and accounting?

Don't worry, we've got your back. At Opolis, we’re not just about making your self-employed journey smoother; we’re about making sure you do it right.

Let’s dive into the nitty-gritty of S-Corp taxes, payroll, and all the juicy details that keep the IRS off your back.

What’s a Reasonable Wage Anyway?

Picture this: you’re the proud owner of an S-Corp, living the small business owner dream.

But wait! The IRS has a stern face on and says, "Show me the money!" They demand "reasonable compensation" for your services.

What’s that, you ask? Think of it like this: it's the salary you would pay to someone else doing the same job in the same industry. It’s vague, yes, but it’s crucial. Overstep, and you’re in hot water. Undershoot, and it’s no better.

Cue in our heroes, the tax professionals. Consulting with a seasoned tax professional or an accountant specializing in S-Corps is your golden ticket to compliance. We’ve teamed up with Darien Advisors for just this reason– they’re the experts who can tailor advice to your situation.

Why Opolis Has Minimum Salary Requirements

Here’s the scoop: to join the Opolis Employee Membership, you need to hit a minimum salary mark. Why? Because we’re all about compliance and smooth sailing.

Here’s the breakdown:

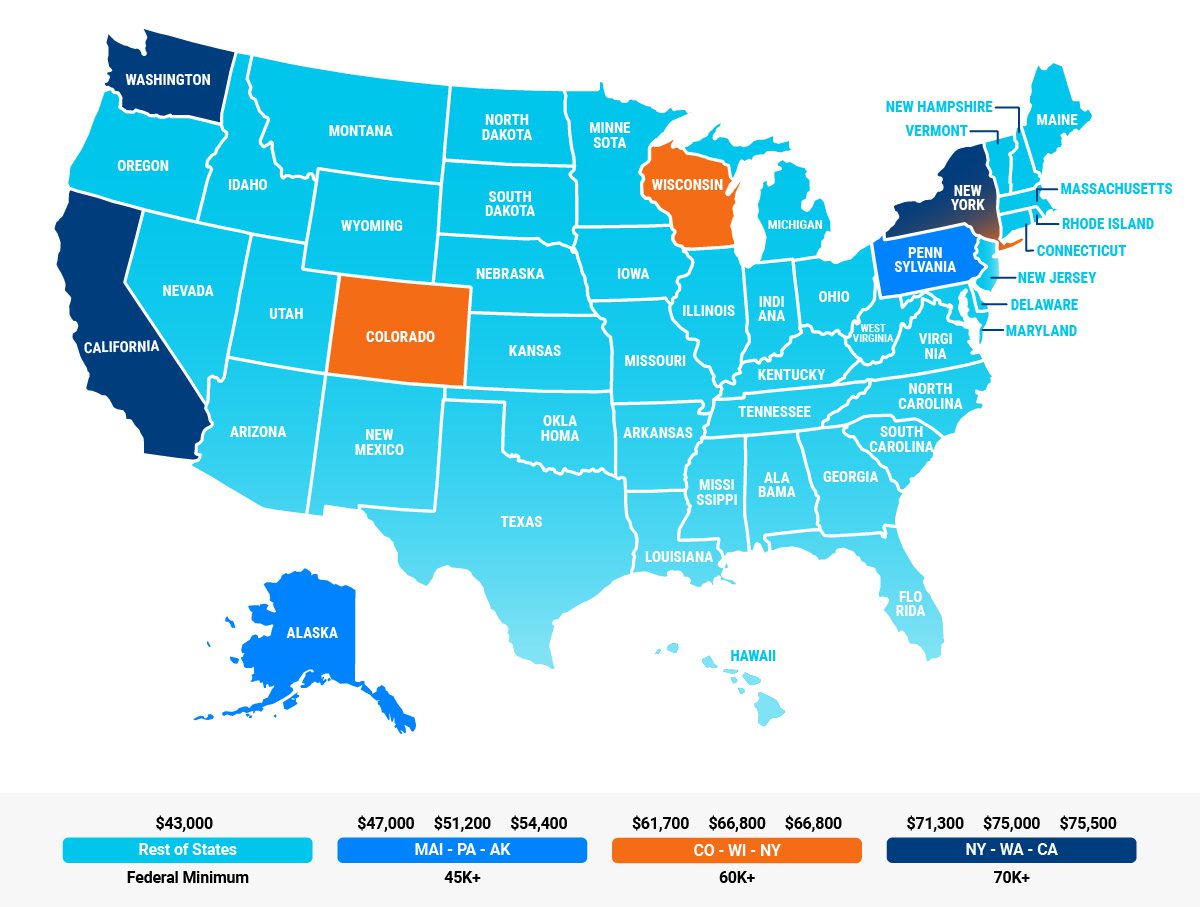

- Full-Time Exempt Classification: For Opolis to be your employer of record, we need to confirm you’re a full-time salaried employee. That means earning at least the exempt minimum wage for your state. Check your state's requirements on the map!

- Group Insurance Compliance: Our group insurance plan is exclusive to full-time employees.

- Benefits Inclusion: Your salary needs to be enough to cover the cost of benefits. This makes it easier to follow ACA rules and manage your accounts.

Questions? Shoot them over to us at [email protected]!

Payroll Tax Licenses: Do You Need Them?

In short, nope. Thanks to the unique structure of the Employment Commons LCA that is Opolis, we handle all payroll tax filings for you. Employment Commons LCA files all payroll taxes – Federal, State, and Local – under its EIN.

If you’ve got open payroll tax licenses, it’s time to close them. Since your business operates differently under our umbrella, you don't have traditional employees. Let us take care of the paperwork and formalities for you.

Need help closing your open licenses? We’ve got a guide for that.

Accounting: What Does Opolis Handle?

Spoiler alert: we don’t do all your accounting (yet ). You’re still the boss of your books, managing income and expenses.

However, we arm you with all the payroll-related data you need for journal entries. You’ll still need to keep tabs on non-payroll expenses separately.

And tools like QuickBooks Self-Employed are your new best friend for creating those all-important profit and loss statements.

Tax Time: What You Need to Know

Navigating tax time with an S-Corp can feel like a double-edged sword. You're responsible for both personal and business tax returns.

But don’t let that overwhelm you– there are distinct advantages to the S-Corp structure. As an S-Corp owner, you’re taxed both as an employee and a business owner, which means you only pay employment taxes on the salary you receive, rather than on your overall profits.

When filing taxes, it's crucial to comply with both federal and state tax authorities in the United States. You must file federal tax returns for both your personal income and your S-Corp.

Be mindful of the time to file, as missing deadlines can lead to penalties and interest. Accurate filing is crucial to avoid a phone call from the taxing authorities!

And sure, managing taxes for an S-Corp business entity can be complex. But that’s why we’re here. Opolis can assist you in understanding and staying organized, and even help you save on taxes!

The Opolis Tax Kit

Every January, we send you:

- A password-protected digital copy of last year’s W-2.

- A digital export of your payroll invoices.

Here’s what you’ll need to file your business taxes:

- Payroll Data Export: Contains gross payroll, taxes, benefits expenses, and fees.

- Last Year's S-Corp Filing: For those vital historical data points.

- Profit/Loss Statement: Categorize expenses and track revenue with precision.

- Personal Information: Full name, address, SSN for the K-1 and S-Corp return.

Personal Tax Return Essentials

For your personal tax return, gather:

- Your Employment Commons W-2

- K-1 from your S-Corp.

- Any 1099s or other personal income tax forms.

- Brokerage and interest statements.

- Rental income and property tax statements.

The Schedule K-1 Explained

A Schedule K-1 is your share of S-Corp profits, passed through to you and taxed on your individual return. Providing Schedule K-1s to shareholders and filing the S-Corp return by March 15th is crucial. If you need help you can consult your accountant or Darien Advisors.

More on why K-1s are your bestie here!

Handling Bonuses and Crypto Gains

Processed a bonus? It’s on your Opolis payroll data export and included as regular wages on your Employment Commons W-2.

Got crypto? Use platforms like Cointracking.info or Koinly.io to generate Form 8949.

Need expert advice? Darien Advisors are your go-to for crypto tax peace of mind.

Wrapping Up

Self-employment with an S-Corp can seem like a daunting quest, but with Opolis, you’re never alone. From fair wages to tax compliance, we simplify your journey.

Ready to conquer the self-employed world? Let's do it together.

Dive deeper into how Opolis is transforming self-employment.

Check out our FAQ or reach out directly at [email protected].

Your tax-efficient future starts now!