Choosing the right legal structure for your business is like picking the perfect tool for the job— it can make all the difference. Today, we're diving into the wild world of business entities: Limited Liability Company (LLC), S-Corporation (S-Corp), and C-Corporation (C-Corp). Strap in, because we're about to decode the complexities and unveil the secrets behind each option.

Unraveling the Mystery: LLC vs. S Corp vs. C Corp

What is a Limited Liability Company (LLC)?

Think of an LLC like a superhero cape for your business— it protects your personal assets from any mishaps that might happen to your venture.

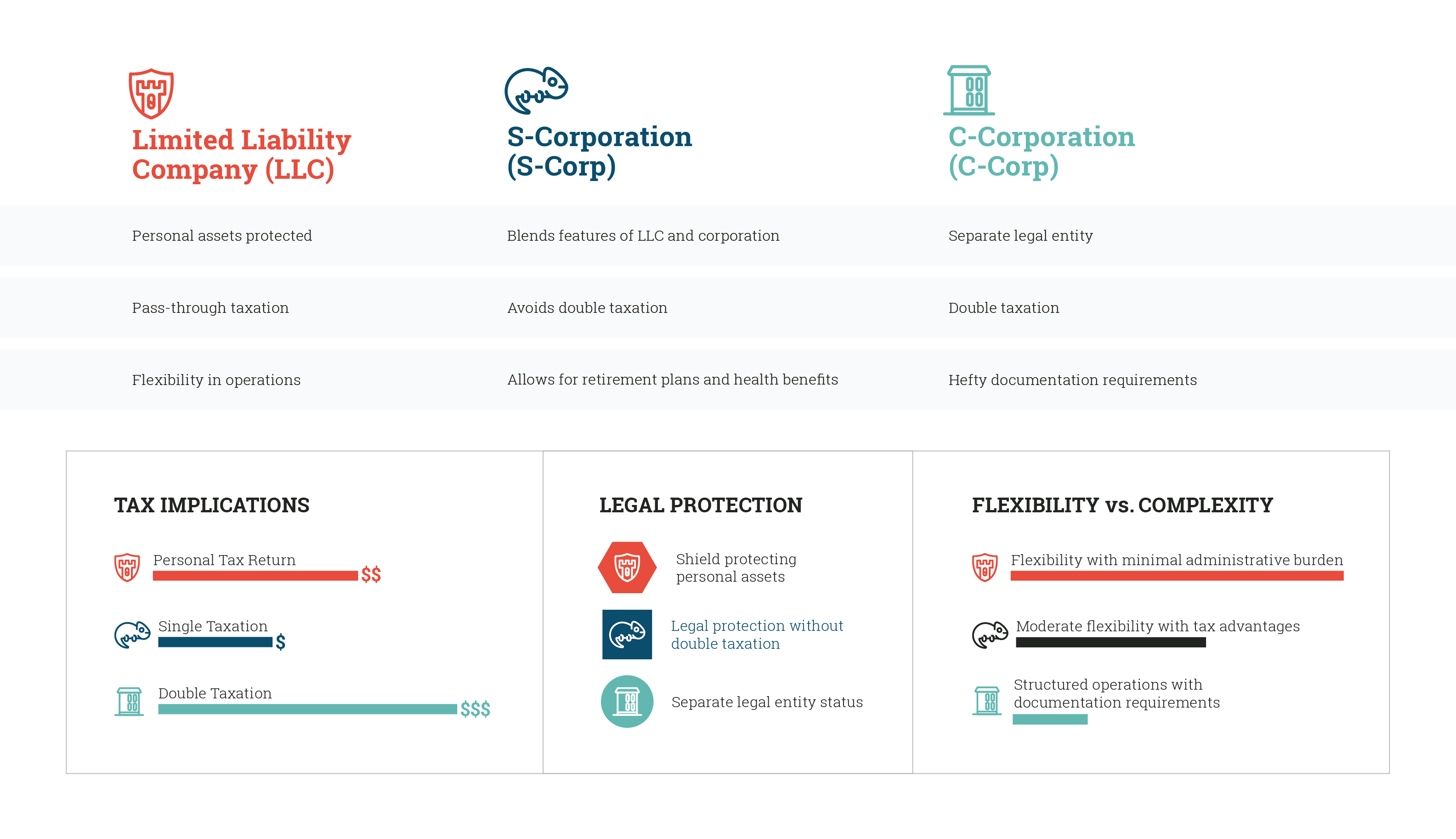

LLCs offer the best of both worlds: the security of a separate legal entity and the flexibility to operate according to how you want. However, here's the catch: while it may shield you from financial calamity, tax-wise, it's not the most thrilling option.

Why not? LLCs are subject to taxation on business income as self-employment taxes, including the hefty 15.3% FICA (self-employment) tax. So your income still finds its way onto your personal tax return, much like it would without the fancy LLC label. And that typically means less money in your pocket.

What is a C-Corporation (C-Corp)?

Ever dreamed of having your own corporation? Well, here's your chance!

What C-Corps can offer that other structures do not are pre-tax benefits like Medical Flexible Spending Accounts (FSAs) and Dependent Care FSAs, providing additional incentives for employees and shareholders alike.

Picture a C-Corp as the corporate bigwig— it's got all the bells and whistles, but with great power comes great responsibility. C-Corps come with hefty documentation requirements and the dreaded double taxation curse.

Yep, you heard that right— profits get taxed at the corporate level, and then Uncle Sam comes knocking again when dividends or payroll are doled out to shareholders. Like paying taxes on your taxes. Ouch!

What is a S-Corporation (S-Corp)?

Now meet the S-Corp— a dynamic hybrid entity that combines the best traits of both LLCs and C-Corps while sidestepping their drawbacks.

Think of the S-Corp as the chameleon of business structures: it seamlessly adapts to your needs, offering the legal protection of a corporation without the headache of double taxation and cumbersome corporate reporting.

S-Corps are akin to the savvy sidekicks in the business world. They shoulder the FICA tax burden only on payroll wages, sparing you from that hefty 15.3% tax on dividends once they surpass the "reasonable wage" threshold. It's like having your cake and eating it too, with a generous side of tax savings to boot.

But wait, there's more! With an S-Corp, you can unlock additional benefits like setting up a retirement plan, capitalizing on substantial tax savings, and accessing coveted health insurance perks. It's the business structure that keeps on giving.

Navigating the Maze: Which Structure Is Right for You?

Feeling overwhelmed by the business entity labyrinth? Let Opolis be your guiding light through the murky waters of LLCs, S-Corps, and C-Corps.

Whether you're a lone wolf or building an empire, Opolis helps you navigate tax efficiency and legal protection. Say goodbye to confusion and hello to clarity with our expert guidance.

Ready to Make Your Move?

Tired of the guesswork and ready to take the plunge? Opolis is here to assist you, whether you prefer the simplicity of an LLC, the prestige of a C-Corp, or the versatility of an S-Corp. Say goodbye to business structure woes and hello to peace of mind with our seamless setup process.

Ready to unleash your independent worker prowess? Get in touch with us today to explore your business structure options and embark on a journey to success.

Email [email protected] now to get started!