Feeling the stress of juggling payroll and taxes solo? Ready to elevate your independent worker journey and tap into a realm of unbeatable benefits and support? Opolis is your answer.

If you're already handling your business on another platform but crave a change, we've got your back. Let us guide you through each step of the transition process. Together, we can help you unleash the full potential of your career.

Step 1: Assess Your Eligibility

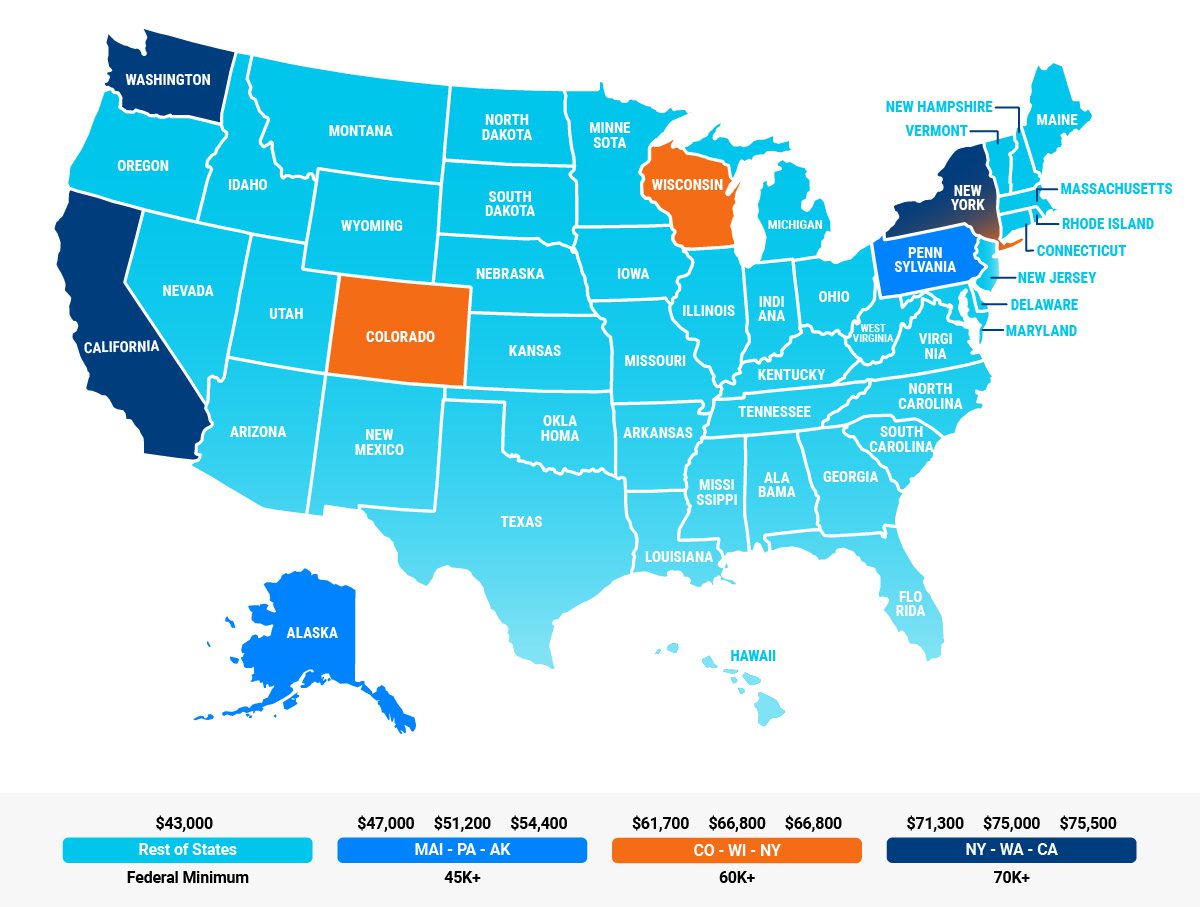

Before you leap into the transition, make sure you're eligible for Opolis membership. Double-check that you can work in the continental U.S. and meet your State's minimum annual income requirements.

Step 2: Evaluate Your Current Situation

Once you know you qualify, dive into your current work platform and identify any pain points you're experiencing.

Are you grappling with subpar health benefits, complicated tax processes, or limited retirement choices? Opolis tackles these challenges head-on by offering customized solutions tailored to your needs as a solopreneur.

Whether you're working for yourself or another company, we'll help you understand the differences between being a 1099 or W2 employee, so you can make the best choice for your situation.

With us, transitioning becomes a no-brainer for a smoother, more fulfilling experience. We understand your concerns and are here to support you every step of the way.

Step 3: Discover Opolis Membership Benefits

Forget the hassle of scouring the internet for healthcare plans— we've got you covered. From top-notch health insurance to hassle-free retirement accounts, Opolis has everything you need.

Plus, say goodbye to the confusion of ending your benefits. Whether your benefits are through another platform, your state exchange, COBRA, or a previous employer, with Opolis you can access benefits immediately. Your benefits go live the same day as your Membership start date— there's no eligibility waiting period.

Explore our website and resources to uncover the full spectrum of benefits awaiting you.

Step 4: Nail Down Your Final Payroll Cycle Date

Transitioning to Opolis requires careful timing if you are joining us from another payroll platform. Ideally, you want it to coincide with the end of a quarter to make those final wage reports and payroll tax returns a breeze. Lock in your final payroll cycle date with your outgoing provider to keep things organized! To help you plan ahead, your Opolis Membership will go live on the 1st of the month and your first payroll will be deposited on the 3rd Friday of that month.

Step 5: Settle Your Payroll Tax Accounts

Once you lock in your final payroll date, it's time to roll up your sleeves and take charge. Call your State's Labor and Revenue Department to close any remaining payroll tax accounts.

Here's what you'll need to know to have the conversation:

Opolis does things a little differently. We step in as the Employer of Record for your business, making the whole payroll tax ordeal a breeze. In fact, we handle all the nitty-gritty payroll tax filings for you under our licenses. That includes the Federal (941/940), State (Withholding and Unemployment), and even those pesky Local taxes (FMLA/SDI/City tax, if they're throwing those your way).

Because we've got your back, say farewell to those payroll tax licenses. You don't need to keep them open under your entity or file reports for wages paid through Employment Commons. And if you have any other licenses lingering, just shoot a message to the State/Federal crew to inform them you've made the switch. Let them know you've joined the Opolis Employment Commons and your business is officially free of employer responsibilities from the day you joined us.

Want the full scoop on our taxes and benefits wizardry? Head over to our website for all the juicy details. Get these tasks checked off pronto, and watch as your transition to Opolis glides along without a hitch.

Step 6: Tie Up Loose Ends with Benefits

Don’t forget to tie up loose ends with your current benefits provider(s). We roll out the red carpet for our benefits on the first of the month, so make sure you’ve cut ties with the old gang before then. And stash some cash for your healthcare premiums— it’s like buying insurance for your insurance.

Step 7: Prepare Your Personal Funds

Lastly, keep some personal funds handy because, let’s face it, waiting for that first paycheck can feel like waiting for the season finale of your favorite show.

You’ll see the first payroll come through on the third Friday of the month. But don’t worry, with Opolis, it’s worth the wait! From now on, you set it and forget it.

Step 8: Make the Switch

Ready to unlock a world of opportunities with Opolis? Our simple registration process gets you onboarded quickly so that you can enjoy Opolis membership benefits right away.

Step 9: Take Advantage of Opolis Resources

Once you're part of the Opolis community, dive into our rich member resources and support. Connect with peers, access exclusive educational materials, and harness our range of tools to boost your career.

Ditch the headaches of tax, payroll, and healthcare management, and redirect your energy towards business growth. Say farewell to the limitations of your current platform and welcome boundless opportunities with Opolis.

Ready to streamline your solopreneur journey? Take the first step.

Sign up for membership now or schedule a call with our team. Contact us at [email protected] today!